In the world of personal finance and business management, budgeting is a critical component that can significantly impact financial health. Among various budgeting methods, zero-based budgeting (ZBB) has gained traction for its systematic and strategic approach. Unlike traditional methods that carry over previous budgets, ZBB requires that every expense must be justified for each new period. This method not only encourages mindful spending but also promotes resource allocation based on strategic objectives rather than historical data.

Zero-based budgeting starts from a 'zero base,' meaning that all expenses must be reviewed and approved for each new budget period, regardless of previous budgets. This requires each department or unit within an organization to thoroughly analyze its needs and justify its expenses. The process of justifying expenses can lead to increased efficiency, as it forces organizations to prioritize their spending based on actual needs and goals rather than assumptions from prior years.

As businesses and individuals seek to streamline their finances and eliminate wasteful spending, zero-based budgeting presents a viable solution. It provides a clear framework that promotes accountability and ensures that resources are allocated effectively. This article will explore how ZBB works, the differences between ZBB and traditional budgeting, its benefits and drawbacks, and how various organizations can leverage this budgeting method.

How Does Zero-Based Budgeting Work?

To implement zero-based budgeting, an organization begins by defining its goals and objectives for the upcoming budget period. Each department prepares a budget based on these goals, outlining expected costs that are directly linked to the activities required to achieve them. This approach necessitates a comprehensive review of all operations and initiatives, ensuring that funds are allocated to the most impactful projects.

Once the initial budget requests are drafted, every expense must be supported by a sound justification. This includes detailing the purpose of the expenditure, the anticipated return on investment, and how it aligns with organizational objectives. By requiring justifications for all expenses, ZBB encourages departments to critically analyze their resource allocation and eliminate unnecessary costs.

After the justifications have been submitted and are reviewed, the organization prioritizes the requested items based on available funding and importance. This prioritization process helps in making informed decisions on where to invest resources and which expenses to cut, ultimately leading to a more efficient budget.

The Differences Between Zero-Based Budgeting and Traditional Budgeting

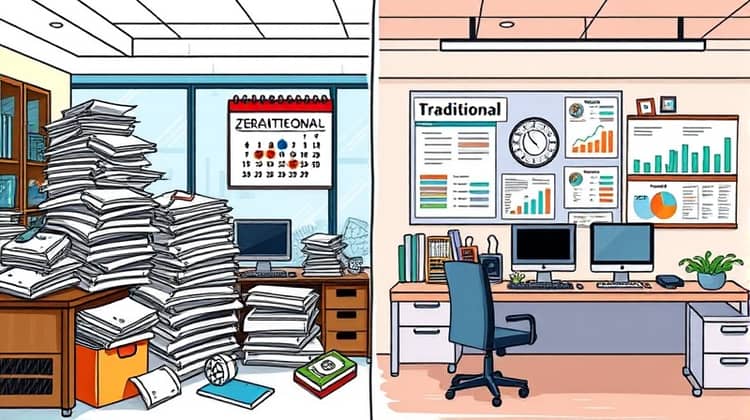

Zero-based budgeting and traditional budgeting are fundamentally different in their approaches to fiscal planning. Traditional budgeting typically involves adjusting the previous year's budget, often leading to incremental increases without a thorough review of each cost item. In contrast, zero-based budgeting starts from scratch, requiring every cost to be justified anew each budget cycle.

This distinction leads to a different focus in allocating resources. Traditional budgeting can perpetuate unnecessary expenses, as departments may simply request increases based on historical spending. ZBB counters this by fostering a more disciplined approach to budgeting that prioritizes essentials over historical precedence.

- ZBB eliminates the pre-established budget assumptions and greatly minimizes waste.

- Traditional budgeting often results in inflated expense estimates due to lack of scrutiny.

Ultimately, the choice between zero-based budgeting and traditional budgeting depends on the specific needs of the organization and its financial strategy.

The Benefits of Zero-Based Budgeting

One of the primary benefits of zero-based budgeting is its capacity to promote fiscal discipline. By requiring every department to justify its budget requests, organizations can ensure that every dollar spent directly contributes to operational goals and objectives. This process not only eliminates waste but also fosters a culture of accountability within the organization.

Moreover, zero-based budgeting can enhance decision-making and strategic alignment. By linking budgets to clearly defined goals, organizations can allocate resources more effectively and respond to changing business conditions with greater agility.

- Encourages critical evaluation of each expenditure.

- Provides clarity on cost management and budget allocation.

- Allows organizations to remain flexible and adapt to changes swiftly.

These benefits make zero-based budgeting a powerful tool for organizations looking to optimize their financial performance and achieve their strategic objectives.

The Drawbacks of Zero-Based Budgeting

Despite its advantages, zero-based budgeting is not without its challenges. One significant drawback is the time and effort involved in preparing a ZBB. The need to justify every line item can be resource-intensive, requiring detailed analysis and documentation that may slow down the budgeting process.

Additionally, ZBB can create an environment of short-term thinking as departments may prioritize immediate needs over long-term investments. This focus on justifying current expenses can sometimes undermine strategic initiatives that require sustained funding and commitment.

- Time-consuming process that requires significant documentation.

- Potential for short-term focus on immediate expenses rather than long-term goals.

Despite these drawbacks, with careful implementation and commitment from management, many organizations find that the benefits of zero-based budgeting outweigh the associated challenges.

Zero-Based Budgeting Can Benefit Many Organizations

Zero-based budgeting can be particularly beneficial for organizations operating in rapidly changing industries where flexibility and adaptability are crucial. Technology companies, for example, often face shifting market conditions that necessitate nimble financial planning. By utilizing ZBB, these organizations can quickly adjust their budgets to respond to new opportunities or challenges without being tied to outdated spending patterns.

Moreover, non-profit organizations and governmental entities that operate under tight budget constraints can benefit from ZBB's emphasis on justifying each expense. These organizations often have limited resources and must ensure that every dollar spent aligns with their mission and maximizes impact.

Finally, zero-based budgeting can also serve as a catalyst for cultural change within organizations. As teams become accustomed to evaluating their expenditures rigorously, it fosters an environment where continuous improvement is expected and encouraged, leading to enhanced operational efficiency.