In today’s fast-paced world, money management can feel like an uphill battle. One simple yet transformative solution is creating multiple savings accounts, each dedicated to a specific goal. This strategy not only clarifies your financial roadmap but also fuels motivation, safeguards critical reserves, and helps you seize the best returns available.

In this comprehensive guide, we’ll explore the key advantages, strategic applications, common pitfalls, and practical steps for implementing a multi-account savings system. By the end, you’ll be equipped to design a personalized approach that aligns with your aspirations and brings every dollar closer to its intended purpose.

Unlocking the Benefits of Multiple Savings Accounts

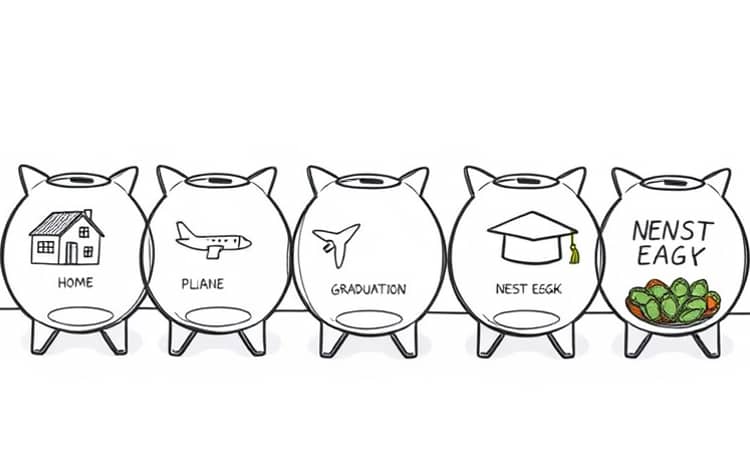

Segmenting your funds into separate accounts creates a powerful visual cue that each goal matters. When you see your “Emergency Buffer” grow alongside your “Vacation Adventure Fund,” you experience goal segmentation and monitoring progress in action. This tangible progress fosters accountability and prevents the mental blur that arises when all savings live in one pool.

Beyond motivation, dedicated accounts act as protective barriers. Having an emergency fund tucked away in a different bank discourages impulse spending and preserves your safety net. This approach instills discipline and ensures that money earmarked for crucial needs remains untouched until truly necessary.

Financial institutions are responding by offering sub-accounts or “buckets” within a single platform. While convenient, the psychological benefit of physically separate accounts at different banks can’t be overstated. Real separation builds friction and discourages temptation, giving you greater confidence in your long-term objectives.

Finally, with high-yield online savings accounts boasting over 5% APY as of 2025, spreading your deposits across institutions ensures you capture the best rates. Combining competitive yields with full FDIC insurance protection up to $250,000 per bank amplifies both growth and security.

Strategic Uses for Each Account

Matching each savings goal to the appropriate account type is essential. Use the following framework to allocate funds efficiently and maximize benefits:

For shorter horizons, prioritize liquidity and zero-fee structures. As timelines lengthen, shift larger sums into accounts that reward you with higher yields. Remember to revisit allocations whenever interest rates or personal goals change.

Managing Potential Drawbacks and Staying Organized

Maintaining multiple accounts can introduce complexity, but a few simple habits prevent overwhelm. First, centralize your view using a budgeting app or spreadsheet. Pull live balances into one dashboard to see progress at a glance without logging into each bank.

Second, minimize fees by choosing institutions with no minimums or maintenance charges. Research online banks known for customer-friendly policies. If you must maintain a minimum balance, automate just enough contributions to stay above the threshold.

Third, schedule a monthly or quarterly review. Confirm that each account serves its purpose, reassign excess cash if a goal is met, and adjust transfer amounts to align with evolving priorities. This practice ensures your strategy stays dynamic and effective.

- Consolidate or close accounts when goals are achieved to reduce administrative load.

- Use calendar alerts for fee deadlines and promotional expiration dates.

- Leverage sub-account nicknaming features for clear goal identification.

Practical Steps to Implement Your Multi-Account Strategy

1. Define and prioritize goals: List every objective—emergency reserve, home purchase, travel, education, retirement—and estimate target amounts and timelines for each.

2. Compare financial institutions: Examine APYs, introductory bonuses, fee schedules, customer reviews, and digital tools for ease of use.

3. Open accounts with intention: Assign clear nicknames like “Wedding 2026” or “Tax Reserve.” Consider setting up at least one account in a different bank to enforce separation.

4. Automate your system: Schedule recurring transfers from checking to each savings bucket right after payday. Automating deposits builds consistency and removes decision fatigue.

5. Track and adjust: Use a spreadsheet or personal finance app to log contributions, interest earned, and timeline progress. Rebalance contributions as income or expenses shift.

Real-World Examples to Motivate Your Journey

Emily opened four separate savings accounts when she landed her first professional role. She labeled them “3-Month Emergency,” “Home Starter,” “Europe Trip,” and “Career Growth Fund.” As each account grew, she celebrated small victories—booking flights once her travel fund reached half its goal and launching a certification program with her career fund. Segmentation made every achievement tangible.

Meanwhile, Marco and Leila took a tax-savvy approach. They established an HSA, maxed out their IRA contributions, and maintained two high-yield savings accounts for short- and medium-term needs. By automating monthly deposits, they never missed a contribution, and when an unexpected car repair arose, their dedicated auto fund covered it without derailing other plans.

A solo entrepreneur, Nathan, relied on three accounts: “Operations Buffer,” “Tax Savings,” and “Innovation Projects.” This structure gave him both the peace of mind to cover lean months and the freedom to reinvest in new services when demand spiked. His clear allocation strategy underpinned his business growth and personal stability.

Conclusion: Embrace Clarity and Control

Adopting a multiple-account savings strategy is more than an organizational exercise—it’s a mindset shift toward purposeful financial living. By compartmentalizing funds, you create accountability, harness emotional motivation, and unlock higher returns. Each piggy bank tells its own story, and every contribution brings you closer to realizing your dreams.

Start today: identify your top priorities, research your options, and set up a system that resonates with your lifestyle. With clear goals, disciplined execution, and regular check-ins, you’ll transform scattered savings into a cohesive plan that empowers you for years to come.

References

- https://www.bankrate.com/banking/savings/reasons-multiple-savings-accounts/

- https://www.citizensbank.com/learning/how-many-savings-accounts-should-i-have.aspx

- https://www.washtrust.com/blog/the-pros-and-cons-of-multiple-savings-accounts

- https://www.pnc.com/insights/personal-finance/save/how-many-savings-accounts-should-i-have.html

- https://www.interiorfcu.org/blog-savings-multiple-accounts/

- https://www.usbank.com/financialiq/manage-your-household/personal-finance/Multiple-accounts-can-make-it-easier-to-follow-a-monthly-budget.html

- https://www.experian.com/blogs/ask-experian/how-many-savings-accounts-can-you-have/

- https://fortune.com/article/how-many-savings-accounts/